People want stuff fast, especially digital stuff. And the world has largely provided stuff quickly, from online entertainment services to digital train tickets, across multiple channels, and usually seamlessly. The banking industry, often handcuffed by tradition, regulation and lack of imagination, is catching up with customer expectations. The road has been bumpy depending on where you live, but progress is evident.

Yet, the concept of open banking has yet to fully integrate its benefits into the lives of UK citizens. Aside from the thorny debate around alleged sabotage by big banks regarding the easy moving of funds between accounts, account origination itself is still a cumbersome process. When people want to sign up for a new bank or building society account, or renew their mortgage, or apply for a loan, there’s still too many hoops to jump through. This is commonly called friction, and you can’t buy stuff, move stuff, or get stuff done quickly with too much of it.

How to quickly acquire customers

The best way to improve the onboarding process and attract customers is to make it quick and seamless. The solution sounds obvious, but many financial institutions (FIs) haven’t cottoned on, or are unable to because of legacy processes. One of the reasons for this is front-end functions aren’t simply married to the back-end. It’s a convoluted mess that would take serious unravelling, which is time-, money- and resource-intensive. This puts FIs off, but our recommendation is to get it done, whatever the cost.

There are many benefits to improving the onboarding process, not least more customers opening accounts and applying for services and products. Other benefits include:

Business efficiency gains: According to Trade Ledger research, lenders waste time with loan monitoring processes and audits, instead of focusing on credit application analysis and loan approval. Only 20% of credit managers invest their time in loan preparation and onboarding!

Enhanced security protocols: A digital transformation project can help discover process fissures that fraudsters look for and use. By better understanding how digital fraud works, you build better defences against them, such as advanced authentication methods (and more). See our recent post: ‘The influence of digital authentication in the mortgage switching process’.

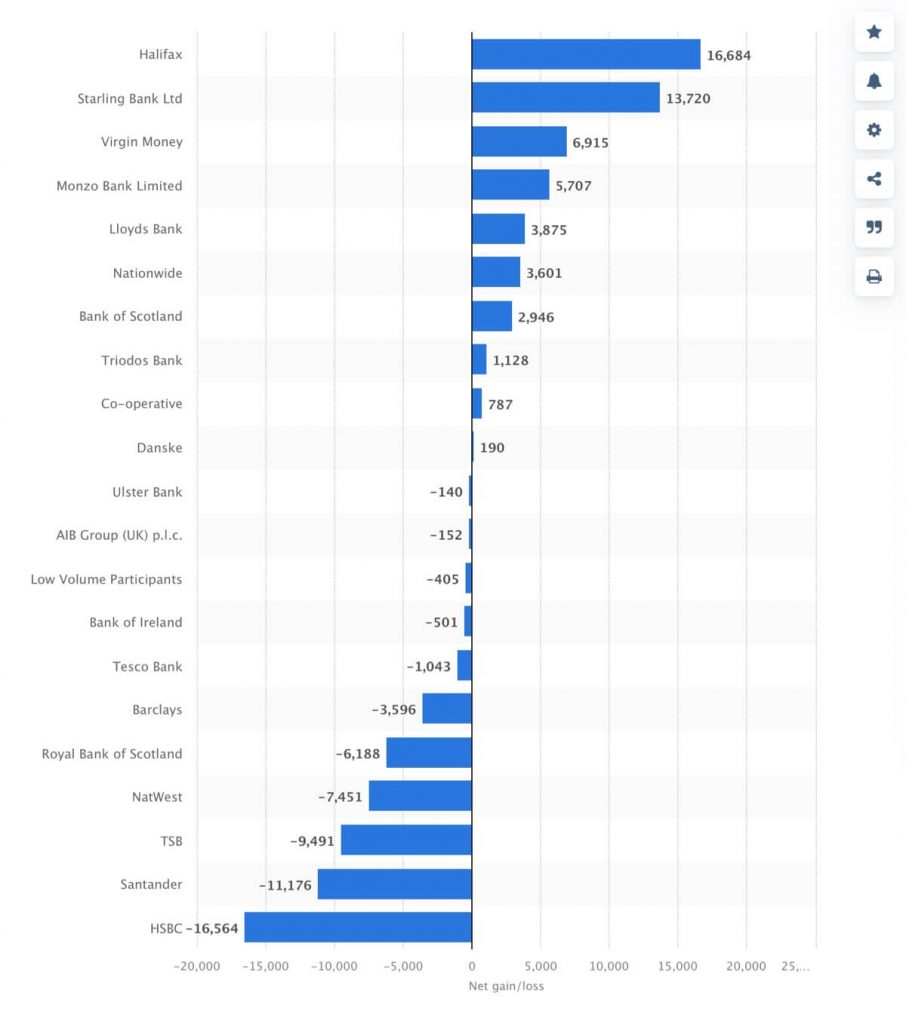

Increased loyalty due to better customer journeys: When you nurture a services-first approach, and address customers’ needs around managing their finances, you inevitably increase engagement and loyalty. If you make the onboarding process smooth by recognising what the customer wants to do, they see this and reward you with their custom. If you want to see who’s making gains in account switching statistics, see the graph below.

You wouldn’t want to be HSBC looking at these statistics. As one of the world’s largest financial institutions by total assets, HSBC propping up the bottom in terms of net loss of customer could be due to many things. If one of them is legacy systems and processes hampering progress, how do you account for Halifax – one of the oldest FIs in the world (and owned by the even older Lloyds) – being top? And spending £6bn on digital transformation means it’s invested heavily, so money can’t be the problem. According to James Hewitson at HSBC UK, “64% of HSBC customers are digitally active”, so customer savvy can’t be the issue.

If it’s lack of urgency, imagination or motivation, these are things FIs can do something about before digital transformation becomes a thing of the past. They are cultural challenges rather than technical. By creating a frictionless, secure application process so that onboarding is seamless, FIs may find themselves at the top end of the above list sooner than they think. Yet, getting there in terms of technology prowess is only part of the battle. If incumbent FIs are nimble, and adopt strategies that will fundamentally alter how they think as organisations, stuff will happen. For everyone.