Customer Stories

A new Digital Experience for a major UK supermarket bank

Creating and owning an entire banking infrastructure is a mammoth undertaking, yet this was the requirement when the supermarket bank became independent of the…

Read moreCase Study

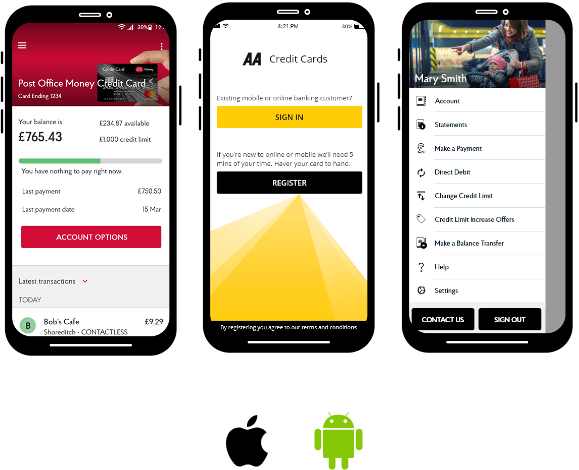

Bank of Ireland UK provided credit card applications and web-based servicing functionality, but lacked a mobile app that could be implemented as a white label platform for their two strategic partnerships with The AA and Post Office Money.

They needed a functionally rich solution that would integrate seamlessly, with real-time transactions, with their credit card back office system provided by TSYS.

This mobile channel needed to be safe to use, be rich in functionality and above all be able to handle the high volumes of usage that met the ambitions of both their partnership programmes.

Our banking software was the natural selection to meet Bank of Ireland’s needs, having already proven to be the best fit for their requirements:

1 – An innovative, high-availability and high-volume digital banking platform already live for other high volume credit card providers.

2 – White label native Android and iOS mobile apps with ready-to-deploy credit card functionality for multiple brands from a single deployment.

3 – Services already successfully integrated and live with TSYS back office systems for other clients.

Beyond the technological requirements, the solution had to deliver two high quality experiences that met the brand compliance for two very different organisations, where customer engagement is a key part of their overall proposition.

Run as a single project, we deployed both The AA and Post Office Money branded mobile apps for both Android and iOS. Benefiting from our experience with white label platforms, Bank of Ireland successfully deployed two completely differently branded mobile app channels from a single implementation.

After launching the service, the Head of Acquisition & Proposition Development at Bank of Ireland UK said, “Having Interact will enable us to provide our customers with a market leading digital experience.”

Since launching our digital platform, adoption increased and the apps have become the dominant channel of choice for customers. Customer satisfaction increased, as well as the usage of the credit cards themselves, increasing transaction volumes as well as the overall size of the book.

Bank of Ireland are the force behind two prestigious UK organisations’ consumer credit card services: The AA credit card is a major component of their wider financial service offerings, while Post Office Money’s credit card is part of their overall consumer banking service provision.

Related content

Customer Stories

Creating and owning an entire banking infrastructure is a mammoth undertaking, yet this was the requirement when the supermarket bank became independent of the…

Read more

Customer Stories

The case for online and mobile app channels for customers to engage, perform transactions and conduct servicing actions was clear: customers who had a…

Read more

Customer Stories

MotoNovo Finance’s plans for growth required a digital-first customer engagement strategy that could scale to meet the expected massive increase in customers. Key to…

Read more

Customer Stories

With five branches within the West Midlands, Dudley Building Society was limited to offering traditional branch-based services to regional members. It recognised that members…

Read more

Customer Stories

Cambridge & Counties Bank wanted to improve the management of its risk assessment ratings, and become less reliant on the digital platform it had…

Read more

Customer Stories

The challenge for many banks, large and small, is how to provide digital services that encourage loyalty through effective engagement and how to…

Read more

Customer Stories

Until the summer of 2021, DF Capital’s interactive channels included telephony and secure messaging, but needed to offer more flexibility to meet customer expectations.

Read more