We provide financial services providers, including banks and building societies with the option to greatly enhance their customer-facing digital platforms in an efficient, cost-effective manner.

Stay in touch with news, views and articles across industry with a technical perspective on digital transformation

Discover the story behind delivering solutions for the biggest names in financial services for 25 years.

Close

Before we get to how digital banking is affecting modern kids, let me take you back to when I was a boy. Piggy banks were all the rage back then. I used to do small jobs around the house to earn money. The joy of getting pocket money from my parents and putting it into a porcelain pig was a playful way to deal with money. When the piggy bank was full, there was the joy of counting the coins, splitting it into individual coin bags, and proudly presenting it to the cashier to deposit into my young person’s bank account.

That was then, this is now. In the UK – particularly for those living in large cities – cash is rarely needed. How easily we pay for our lunch, or an Uber ride home, with an incredibly complex, yet simple-to-use NFC payment. Everything can be paid for with a tap or swipe. In fact, it’s horrifying when you walk into a small takeaway shop or get a taxi in a rural area, only to be told “it’s cash only, mate”.

The value of money is even further lost when we consider larger purchases. Four years ago, I bought a new TV from Amazon. Well, I say I bought it, when actually my daughter did. She was two years old at the time. My recently browsed-for TVs were highlighted in the app, and my daughter picked up my phone and tapped on the infamous ‘Buy Now’ button. This leads to some interesting challenges. How do we teach children the value of money when things can be so easily purchased?

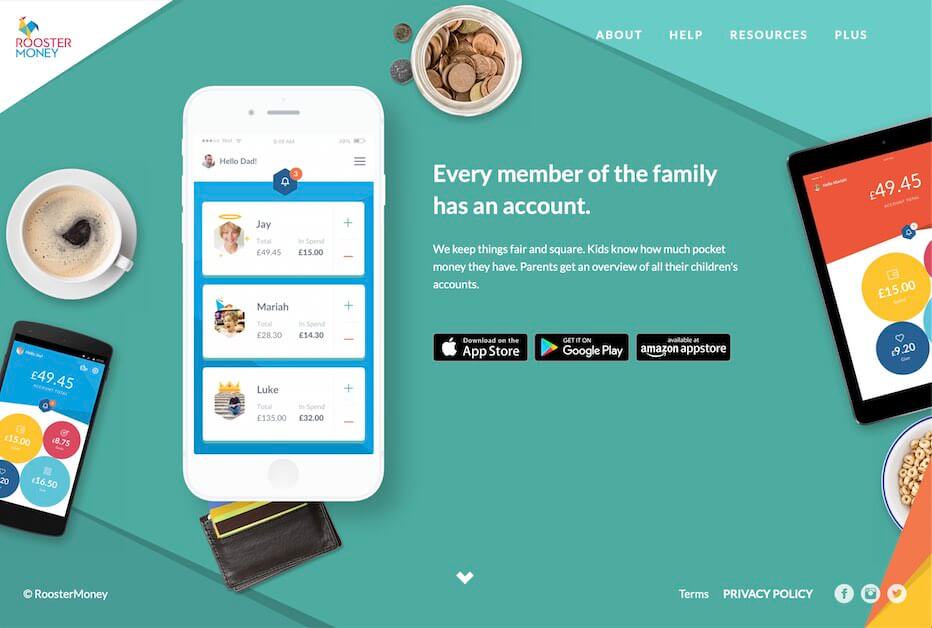

There are several apps and services that have been borne out of today’s digital approach to things. Children as young as six can get their hands on real debit card transactions through services such as gohenry, and Starling Bank recently launched current accounts for 16 and 17-year-olds. Focusing on pocket money in particular, RoosterMoney offers an app that empowers young people, but is controlled by parents. These services not only allow for the single-tap experience so prevalent in the cashless society we live in, through great design and simple journeys, they also provide unique experiences.

Kids love to personalize things. Having their own personally designed debit card makes it so much more appealing to children. It also hopefully means they’re less likely to lose it. If they do happen to lose it, they can always block the card through the app to ensure their pocket money isn’t used by their envious siblings (who already spent this week’s allowance).

So here’s how pocket money typically works in the digital age. The scenario I’m using is a mobile financial app, where each child has their own ‘area’. As a parent, I have my own area of the app, and I can choose to give my child some pocket money, either as a reward for doing small jobs around the house for example, or as a regular amount. The child can use that money for spending via their own debit card, or move it into a savings pot for putting towards a long-or short-term goal. They may even choose to put money aside for charity. The debit card will only work up to the amount assigned to their wallet. There are no overdrafts, therefore no overdraft fees, leaving parents with the peace of mind that their offspring won’t go on a spending spree.

Parents can help their children manage their money by reviewing spending patterns, or help make long-term savings goals, advising them on how to spread their money through the month. It makes the parent and child feel empowered, and gives the child the renewed sense of freedom that money provides.

It’s all very instant. No porcelain pigs. No trip down to the bank with a clunky coin bag. No 24-hour wait to use that money. No out-of-control spending. The power of simple mobile journeys that digital-native kids understand (like, totally) has provided new opportunities to tap into customer loyalty. Not only that, but while we may miss putting coins into the small slot on a pink pig, the digital age now allows for greater education on how to manage money, while letting kids be kids.

Modules

with Interact Acquire

Easy onboarding and personalised account management without visiting a branch.

with Interact Switch

Increase mortgage retention rates allowing customers to compare multiple mortgage products.

with Interact Connect

Self-service banking giving customers full control of their products and services.

with Interact Collect

Improve collection performance with a fully customisable self-service platform.

We provide financial services providers, including banks and building societies with the option to greatly enhance their customer-facing digital platforms in an efficient, cost-effective manner.

Smart and engaging digital solutions for members.

Secure cloud based solutions tailored to banks CX needs.

Providing customers with a better CX experience.

Streamlining processes for Intermediaries.

Technology for slick self service customer engagement.

Making mortgage switching easier.

Deliver better outcomes with digital debt collection software.

Customise your platform with the design and features your members will love.

Stay in touch with news, views and articles across industry with a technical perspective on digital transformation

Event

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

Learn moreA dive into the issues, challenges and technology shaping industry.

Topical feature articles, news and conversation from the ieDigital media newsroom.

Join & connect with us at the latest events we are sponsoring, exhibiting and speaking at in 2022-2023.

See how our customers are building great experiences & success with ieDigital.

Discover the story behind delivering solutions for the biggest names in financial services for 25 years.