Insights

Why internal buy in is essential for a smooth digital transformation journey.

The ability to manage our finances online, 24/7/365, is the new normal. The rate of digital transformation has escalated beyond all measure over recent…

Read morePlatform

Put your customers in full control of their products and services. Interact Connect tailors the digital banking experience with your customer’s needs.

Put your customers in full control of their products and services. Interact Connect tailors the digital banking experience with your customer’s needs.

Key features of

Set business rules for products and accounts to support AML processes and reduce fraud.

Immediate interaction online that feels personal. Our secure portal gives customers access to all of their accounts online, allowing customers to reach out on their terms via live chat.

Interact Connect is a ready to go, fully secure platform that meets PCI, DSS and SCA compliance, complete with 24/7 support.

Take payments and reduce arrears with a range of money-management tools, helping customers with their financial well-being.

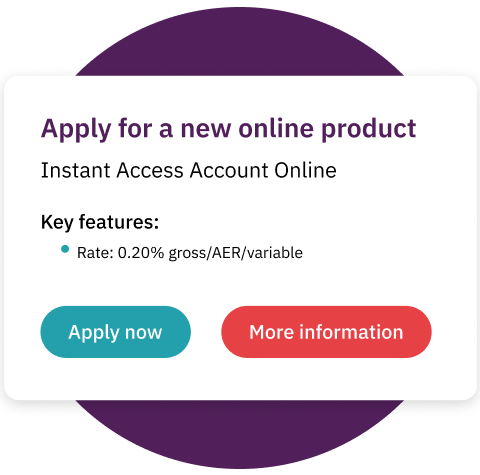

Personalise product offers to individual customers while they use services on their account.

Immediate interaction online that feels personal. Our secure portal gives customers access to all of their accounts online, allowing customers to reach out on their terms via live chat.

With our pre-integrated, industry standardised digital service, Interact Connect is easy to configure and quick to customise to your needs. Interact Connect can be implemented in weeks, not months.

Interact Connect is a ready to go, fully secure platform that meets PCI, DSS and SCA compliance, complete with 24/7 support.

Ebook

For more information about Interact Connect, download our user guide below.

Please download your file below.

Download file

Customer Success Stories

Critical to their future success would be the selection of digital banking capability. Security, resilience, high availability and performance were of course critical to success, but in addition the supermarket bank needed to give their customers superior digital banking solutions, rich in functionality.

Customer success story

Customer Success Stories

Until the summer of 2021, DF Capital’s interactive channels included telephony and secure messaging, but needed to offer more flexibility to meet customer expectations. Following feedback from its savings account holders, the business decided to enhance the functionality of its digital self-serve capabilities.

Customer success story

Customer Success Stories

MotoNovo Finance’s plans for growth required a digital-first customer engagement strategy that could scale to meet the expected massive increase in customers.

Customer success storyRelated content

Insights

The ability to manage our finances online, 24/7/365, is the new normal. The rate of digital transformation has escalated beyond all measure over recent…

Read more

Insights

Without a doubt, technology is one of the great enablers of a truly accessible financial services sector. The ability to access your money, review…

Read more

Press

ieDigital, Connect FSS and ABAKA are integrating within a single identity, a move designed to offer clients a sophisticated and enhanced suite of digital…

Read more

Press

ieDigital has today announced the acquisition of ABAKA, the AI – recommendation engine platform which uses machine learning and behavioural segmentation software to predict…

Read more

Insights

With both their roots firmly in the communities they serve, building societies and credit unions can learn from each other’s digital strategies.

Read more