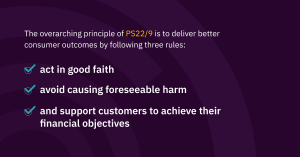

The FCA’s new Consumer Duty, PS22/9, aims to “set higher and clearer standards of consumer protection across financial services and require firms to put their customers’ needs first”. Coming into force in July 2023 for open products and a year later for closed products, the Duty emphasises fairness and a greater level of support for customers as they pursue their individual financial goals.

With the deadline now passed for implementation plans to be submitted, leaders are turning their attention to the hard work ahead. However, very few are confident that their organisation will be compliant by the deadline, which means they’re looking for fast, efficient, and cost-effective ways to improve the customer experience across their product portfolio.

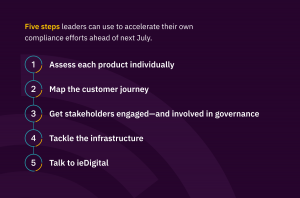

In part one we explored some of the motivations behind the FCA launching this new Duty, and highlighted key challenges that are preventing organisations reaching compliance right away. In this post, we’re sharing a few steps and tools leaders can use to accelerate their own compliance efforts ahead of next July.

While it’s important to have a holistic view of the whole product portfolio, breaking it down into individual products will help leaders identify which parts won’t be compliant with the Duty. To use a mortgage as an example: are the terms of the loan laid out as clearly as they should be? Is the agreement fair? Can customers make a fully informed decision about their house purchase with this product?

The new Duty doesn’t just concern what financial services organisations are providing—it covers how they provide it, too. Charting the customer journey, from initial contact to product selection, and ongoing support to cancellation, will identify gaps in the quality of service the organisation delivers. This will also highlight where there’s untapped data available, which will be invaluable for ongoing optimisation work.

This initiative can only succeed with full buy-in across the organisation. Product owners from across the portfolio should be involved from the start to ensure they know their new responsibilities. Forming a governance board is key, as well as naming a board champion who has wide visibility and executive power to drive the project forward.

So many financial services organisations run on outdated legacy infrastructure, which can make big, rapid changes all the more difficult—and even those with modern core banking systems may not have the flexibility or capability to reach compliance. To meet the Duty’s high demands of communication, personalisation, transparency, and user-friendliness, these systems have to change. Understanding which technology powers which process is vital, and will help leaders identify which solutions are no longer fit for purpose.

Reaching compliance with PS22/9 may be a heavy workload for some financial service providers—but there are ways to simplify the journey, providing unparalleled customer experiences while streamlining backend processes.

Our Interact Application Suite is a collection of customer engagement tools built specifically for financial services. Working alongside your existing infrastructure, our Interact solutions are ideal for meeting PS22/9’s demands, and future-proofing your organisation for whatever comes next.

Every application in our suite is designed to provide clear, personalised communications, and put more power in the hands of customers while giving them easy access to the support they need to achieve their financial goals. In the push for PS22/9 compliance, they’re the ideal way to accelerate your initiative and give your customers the experience they deserve.

You can learn more about the Interact Application Suite here—and don’t hesitate to get in touch if you’d like tailored advice on how our solutions can help you on your organisation’s journey to PS22/9 compliance.