Suffering from anxiety? Headaches? Lack of confidence? You could be an auto finance provider. Times are complicated and the heady mix of regulatory infrastructure, EVs, new competition and Covid-19 uncertainty must be playing havoc with your mental health. The good news is that there’s a magic pill called customer experience that could help you sleep better at night.

Customer experience, if you haven’t heard yet, is an excellent starting point for running most businesses post-2010. As each generation morphs into the next, it produces customers who are more discerning about the services they take up, more demanding around transparency, and more protective of their data. And when it comes to how they buy a car, the picture looks a lot different than it used to.

A unified customer journey

The days of getting away with setting high APRs may not be completely over, but when it’s only one of a bunch of buying options across a range of services from a range of competitors, it would be foolish to make it your only offer. There’s still a tendency for the customer to get wrapped up in the excitement of driving a new car while overlooking the total cost of the finance deal, but more people are looking at lots of different finance options. The key to unlocking your future as a motor finance provider is to drill down on the basics of what attracts a modern customer.

Current buying methods include paying outright with cash (but more than 90% of us don’t do this), a bank loan (or similar), hire purchase (only 10% of buyers do this), the popular personal contract purchase (PCP), and leasing (12% are doing this, and it’s rising). You know all of this already, but it isn’t always easy for buyers to see the pros and cons, at least from the finance providers themselves. This is because the user journey is often over-complicated.

Bucking this trend are the likes of Tesla and Volvo, with the facility to offer buyers a seamless dealership-free transaction that cuts out a lot of traditional baggage associated with getting a car. By baggage, we mean the disconnected stages of:

- doing your research; shortlisting cars

- finding the right finance option

- finding insurance

- post-purchase maintenance/servicing.

The new user journey combines these stages into a unified customer journey – everything under one roof. The process of getting your dream Tesla is so simple, it makes a mockery of the traditional purchasing journey we’ve become accustomed to. In a previous blog post, we said: “The experience exemplifies a company that sees beyond the car, to the relationship the company wants to have with you as their customer.”

And that’s the key to operating as a 21st century car finance provider: Be integrated with all the things a customer wants, so that they don’t have to do all the work themselves. This means offering everything: the car, the finance, the servicing, the insurance, and more – all wrapped up in a seamless digital, convenient experience.

Encouraging customer loyalty

Volvo does a great job of presenting a simple user journey. After creating a Volvo ID, a budget calculator helps people figure out what they can afford, before configuring the vehicle, applying for finance and organising a home delivery. Yes, a car straight to your front door! The benefits for the customer are obvious, but the benefits for Volvo are just as good. The Volvo buyer is joining an ecosystem not unlike how Apple successfully operates. It’s clever business, and the buyer gets a new Volvo.

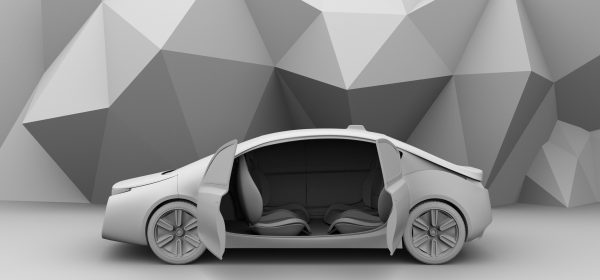

The emergence of electric vehicles and autonomous vehicles means motor finance is set for significant change this decade, but with an eye firmly on what the customer wants to experience when they purchase a car, it’s hard to go wrong. Get the journey right and leave behind the traditional baggage of “how things have always been” and you could be reaping the rewards of customer loyalty for a long time to come.

Photo by anyaberkut