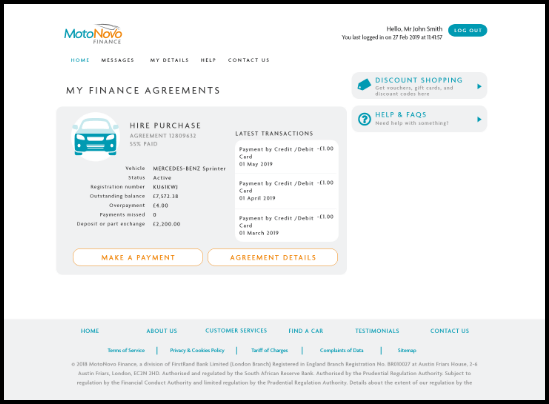

MotoNovo Finance’s plans for growth required a digital-first customer engagement strategy that could scale to meet the expected massive increase in customers. Key to success would be the adoption of customers to self-serve their agreements, without overloading the contact centre with inbound query and servicing calls. The channel had to be safe to use, easy to adopt and be rich in functionality. It also had to be capable of expanding to support future product lines, as the business grows.

At the same time, the FCA were starting their review of the motor finance market, with the focus on, “the potential for consumer harm and whether firms are adequately managing risks” . Market Analysts had started to advocate digital services as a way motor finance providers could tap in to the benefits already seen by banks, if only they could find the right partners with the capability to understand and adapt their solutions to the specifics of the industry.